While compensation climbs for senior HTM leaders, technicians report stagnant pay and the lowest levels of job satisfaction.

By Alyx Arnett

As 2025 came to a close, salary data from the healthcare technology management (HTM) field showed a growing divide between senior and early-career roles. Pay continued to rise for managers, directors/executives, and clinical engineers, while wage growth slowed or declined for many technicians.

Results from 24×7’s 2025 Salary and Job Satisfaction Survey, based on responses from more than 600 HTM professionals nationwide, point to a growing gap between senior and early-career roles, with entry- and mid-level technicians also reporting the lowest job satisfaction. With a significant portion of the current workforce nearing retirement, the data raises questions about how the field will attract, retain, and fairly compensate its next generation of talent.

A Tale of Two Compensation Trends

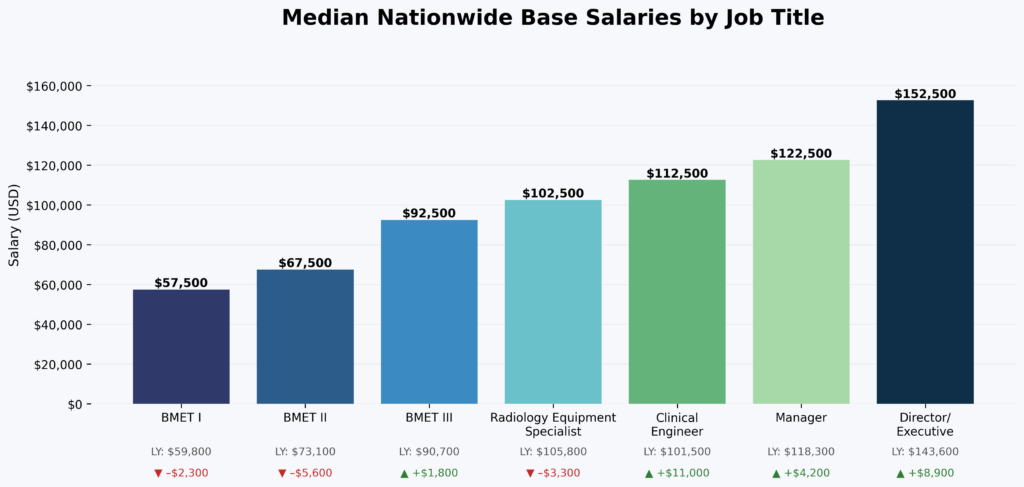

After a mixed report in 2024 that saw director-level pay decline, this year’s survey shows a dramatic rebound for senior leadership. The median salary for directors and executives rose to about $152,500 in 2025, up from $143,600 in 2024. Managers also saw an increase in pay, with median salary rising to about $122,500 in 2025, up from $118,300 the previous year. Clinical engineers followed suit, with median pay rising to approximately $112,500 from $101,500 in 2024. Senior BMET IIIs also saw modest growth, with their median salary inching to $92,500, from a median of $90,700 in 2024.

However, this upward trend did not extend to all roles. Median salaries for BMET IIs declined to $67,500, down from $73,100 in 2024. Entry-level BMET Is also experienced a slight dip, with median pay settling around $57,500 compared to $59,800 the previous year. Radiology equipment specialist median pay also declined to $102,500 in 2025, down from $105,800.

This divergence suggests that in a tight labor market, organizations are prioritizing retention and reward for senior, experienced talent, while compensation for early- and mid-career technicians has not kept pace with broader economic trends. As one respondent noted, “Compensation is the biggest issue because of cost of living and how wages have been stagnant since COVID.”

Beyond base salaries, other forms of cash compensation remain a key part of the financial picture for many. Nearly 60% of respondents reported receiving overtime pay, and 46% received a bonus in the past year. However, a quarter of professionals received no additional cash compensation at all. For those who did, the amounts varied widely, though nearly 14% received between $1,000 and $1,500.

When asked how fairly they believe they are compensated relative to their education and experience, a majority of respondents (54%) rated their pay as fair or very fair. About one-quarter described their compensation as neutral, while just over one in five reported feeling undercompensated.

Regional Disparities Persist

Where an HTM professional works continues to have a significant impact on their earning potential. The 2025 data reveal considerable salary variations across US Census regions, particularly for technician and specialist roles.

For senior BMET IIIs, the Pacific region stands out for both its high ceiling and its wide variability, with salaries spanning from the high five figures to a notable 11% of respondents reporting earning between $175,000 and $179,999. New England also offers robust compensation for senior technicians, with a majority earning over $90,000 and several reporting salaries above $130,000. In contrast, the East South Central region shows a tighter cluster, with most BMET IIIs earning between $90,000 and $100,000.

Clinical engineer salaries also show dramatic regional differences. The West South Central region reported the widest salary spread, with pay ranging from the $70,000s to over $175,000. The Mountain region also showed high earning potential, with a quarter of respondents earning over $160,000, though the sample size was small.

Leadership compensation is consistently high across the country, but top-tier salaries are concentrated in specific areas. In the Pacific region, all responding directors and executives reported earning in the highest bracket of $175,000–$179,999. The South Atlantic region also showed strong executive pay, with more than a third of directors falling into that same top bracket.

These regional differences highlight the influence of local market conditions, cost of living, and demand for specialized skills on HTM compensation nationwide.

Satisfaction, Workload, and the Search for Greener Pastures

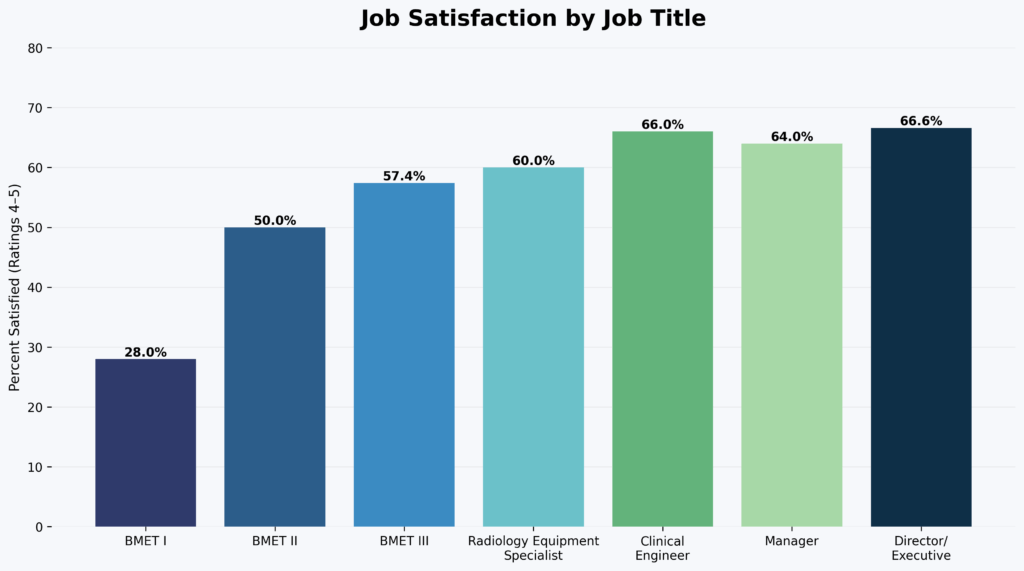

Job satisfaction in the HTM field appears closely tied to seniority and compensation. Directors report the highest levels of job satisfaction, with roughly two-thirds rating their job a 4 or 5 on a five-point scale. Managers, clinical engineers, and radiology equipment specialists also report strong satisfaction, with about 60% or more in each group giving high marks.

The sentiment is more muted among early-career professionals. Entry-level BMET Is report the lowest satisfaction, with more than half rating their job a 3 or lower and only one respondent (4%) describing themselves as “very satisfied.” This dissatisfaction may be linked to compensation and perceived opportunities for advancement. Nearly half of BMET Is rated their promotion opportunities as poor or below average.

This sentiment carries through the technician ranks, with over 50% of BMET IIIs rating their promotion prospects as poor or below average. One respondent lamented the “politics and unqualified leadership” at their workplace, while another cited frustration with a “chain of command [that] has no biomed experience.”

This perceived lack of internal mobility may be driving a significant portion of the workforce to look elsewhere. Nearly 30% of BMETs at all three levels reported they are actively looking for a job outside their current organization. Managers and directors are not far behind, with about one-quarter of each group exploring external opportunities. Clinical engineers appear to be the most stable group, with only 17% actively job hunting.

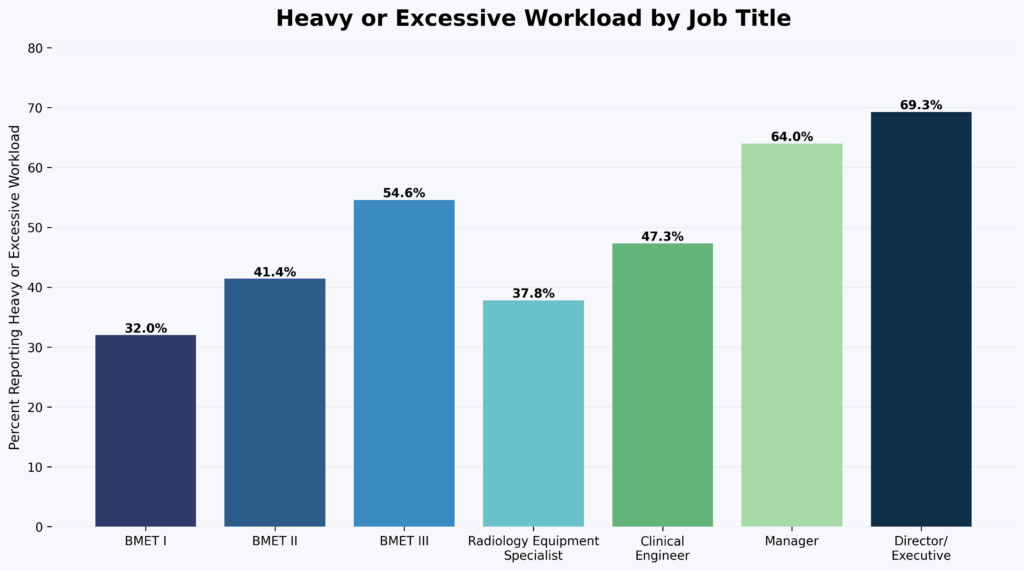

Compounding these issues is a persistently heavy workload. Nearly 70% of directors and 64% of managers describe their workload as “heavy” or “excessive.” Senior BMETs are also feeling the strain, with nearly 55% reporting a heavy or excessive workload. Respondents attribute this to a variety of factors, including staff shortages, organizational growth, and expanding responsibilities. “It seems like there is always a need to expand job responsibilities but little interest or understanding from our administration in increasing the number of FTEs to support the additional work,” one professional wrote. Another stated simply, “We are short 2 techs.”

An Aging Workforce and an Empty Pipeline

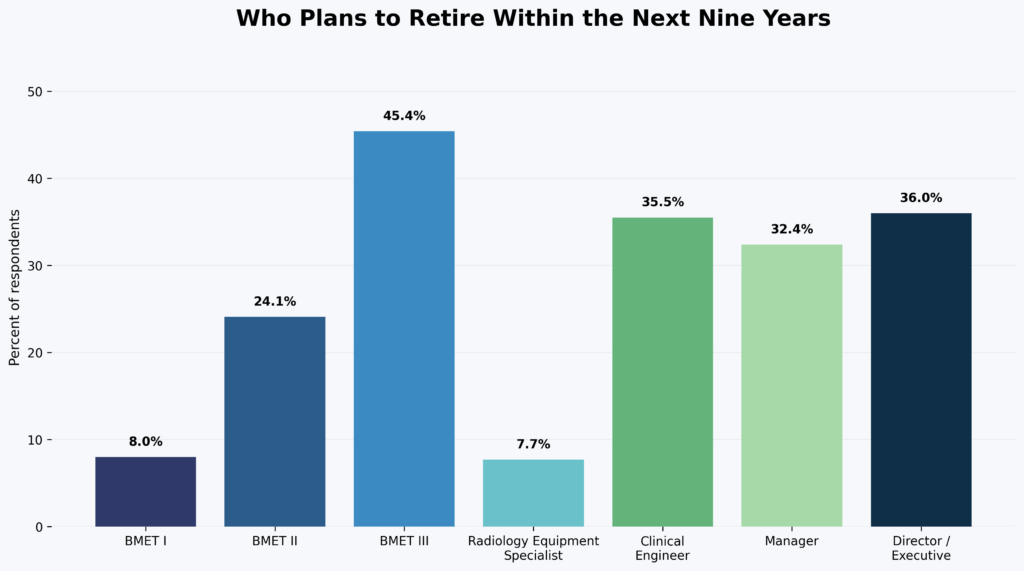

The survey data paints a clear picture of an experienced but aging workforce facing a looming retirement wave. Just over half of BMET IIIs are between the ages of 45 and 59, with 22% aged 60 and older. Additionally, nearly 60% of directors are 50 or older. In contrast, clinical engineers skew younger, with 85.8% under age 40.

Retirement timelines confirm the impending challenge. About 45% of BMET IIIs plan to retire within the next nine years. Retirement risk is also elevated among leadership and clinical engineers, with roughly one-third of managers (32.4%), directors (36%), and clinical engineers (35.5%) indicating near-term retirement plans. This exodus of institutional knowledge and experience is set to collide with what many respondents describe as a severe shortage of new talent entering the field.

“The top issue we have in the HTM profession is getting young people excited about the profession,” one respondent stated. “More people are retiring than entering the field. There are fewer biomed schools to train technicians than there were 15 years ago.”

Another shared a similar concern: “Lack of new blood coming into the field. Without a national push in the mainstream media to enlighten the public, I just don’t see how we are going to increase the numbers entering the field.”

Many feel the industry itself is to blame. “The HTM field does a HORRIBLE job at marketing the field,” one professional stated. “If nobody knows about the job, how do you get new people??”

Some respondents reported their organizations are taking proactive steps, such as partnering with local high schools and colleges, establishing internship programs, and working to make salaries more competitive. However, many respondents reported their workplaces are doing little to nothing to attract and retain talent. “Our corporate office wants a super talented professional NASCAR team but shops for tools at Harbor Freight… and then wonders why nobody applies for jobs,” one person stated.

Confronting the Field’s Greatest Challenges

Beyond the talent pipeline, HTM professionals identified several other critical issues shaping their work. Medical device cybersecurity remains a top priority, with many respondents stating their organizations are investing heavily in dedicated cybersecurity teams, enhanced monitoring, and closer collaboration with IT departments. “We have followed all AAMI recommendations on medical device cybersecurity,” one respondent noted. “We’ve worked really closely with IT and involving their expertise when it comes to connectivity and how to mitigate risks.”

The perennial “right to repair” issue also continues to be a major source of frustration. Professionals cited the “monopolistic behavior of manufacturers” and restrictions on service information and training as significant obstacles to performing their jobs effectively. “Losing the ‘right to work’ on equipment, it’s hard to help when I can’t even buy parts to remedy easy situations,” one person wrote.

Despite the myriad challenges, the fundamental appeal of the profession remains strong. When asked what they like most about their jobs, respondents overwhelmingly pointed to the intellectual challenge, the variety of the work, and the direct impact on patient care. “Knowing I make a difference in patient outcomes by making sure the tools the doctors and nurses are ready for use,” one wrote. Another praised it as a career where they have “been able to continue learning, been challenged every day, advanced in several directions, and earned a good living.”

This intrinsic motivation is reflected in the fact that nearly 70% of professionals are “likely” or “very likely” to recommend the HTM field to others. As one put it, “With all its flaws, healthcare technology management is a rewarding field. It checks off the fulfillment box when it comes to doing a job that’s bigger than just money.”

The 2025 survey data makes it clear that for the HTM profession to thrive, that sense of fulfillment must be matched with competitive compensation, manageable workloads, and clear pathways for growth—not just for senior leaders, but for the technicians who will carry the industry into the future.

ID 166126382 © Andrii Zastrozhnov | Dreamstime.com

Alyx Arnett is editor of 24×7 Magazine. Question or comments? Email [email protected].

Nice to see my this isn’t a localized problem in the biomed field. Everyone is dissatisfied. I’ve been salty since the day the medical center decided to rip the carpet out from underneath us selling the department to a 3rd party. Its lovely being told what to do by someone whose “screwing off from home” 450 miles away rather than locally. We dislike it and the staff on the floors are rather disgruntled with it.

The HTM model is broken, and it may take a total industry ‘reset’ for meaningful change to occur. Currently, technicians are discouraged from taking initiative because there is zero financial incentive to do so. Between inflation-eroded raises and the ‘plate-spinning’ required by expanding workloads, the pressure is at an all-time high. We must move away from holding training over employees’ heads and start investing in them properly. If the industry doesn’t change fast, we’re see a mass departure once the long timers go into retirement. Nobody is going to pick up the slack for what were being given today