Hybrid imaging anticipated to be key driver in market growth

By Elaine Sanchez Wilson

Recent market analysis shows that the last two decades have seen rapid technological advancements in the field of nuclear medicine. Contributing to the segment’s growth are the increasing incidence and prevalence of cancer worldwide, along with mounting awareness of the importance of early diagnosis of chronic diseases.

To discuss the current state of the market and future trends, 24×7 Magazine reached out to a panel of experts representing the top vendors in this market segment. Roundtable participants included Edgar Alvarez, director of service business management for molecular imaging at Malvern, Pa.-based Siemens Healthineers; Michael Barber, president and CEO of MICT at Waukesha, Wis.-based GE Healthcare; and Kirill Shalyaev, PhD, general manager and vice president of advanced molecular imaging at Philips Healthcare in Andover, Mass.

24×7: What factors are currently shaping market demand for nuclear medicine technologies?

Edgar Alvarez: Four major drivers are increasing demand for SPECT, or nuclear medicine. The first driver is the typical population demographics. You have an aging population, which over time needs more advanced care. Obesity rates also are increasing, which would lead to more advanced care—cardiology, oncology, etc. So the demographics of the U.S population definitely point toward growth in nuclear medicine in terms of procedures.

The other driving factor is the availability of new radioisotopes. Quite a few are being tested in Europe. Over time, in the United States, we will introduce and hopefully obtain FDA approval for those SPECT-related pharmaceuticals. Again, we would anticipate growth patterns similar to those seen on the European continent.

Another element that’s really going to drive growth as public and private payers move toward bundled payments is theranostics, where you combine therapy and diagnostic imaging to treat a patient and visualize what is happening to that patient and the disease. Academic institutions in the U.S. are already conducting work in this area, and we see theranostics growing in Europe.

The final factor driving market demand is the need for hybrid imaging.

Michael Barber: Nuclear medicine is moving to hybrid imaging. The combination of a CT and nuclear medicine exam provides more information to a clinician to make a diagnosis. Nuclear medicine provides functional information, whereas CT provides anatomical information. The combination of the two gives a radiologist or nuclear medicine physician the localization of the lesion(s) and, therefore, a more comprehensive report to a referring physician who can then make appropriate treatment decisions.

Kirill Shalyaev: There are a number of factors driving the evolution of the nuclear medicine and molecular imaging market, which include a rise in chronic diseases, the significant growth of an aging population, and increasingly limited global resources.

No solution alone can address a growing, aging population and the increase in chronic and lifestyle diseases, among other pain points in our global healthcare system. This unique combination of factors require an integrated approach that accesses and analyzes data drawn from a multitude of sources, making critical information available to patients and caregivers when, where, and how they need it.

Molecular imaging is evolving to fulfill these needs, providing better access to more integrated diagnostic imaging technology, which will continue to be critical in improving patient care.

Philips, for one, has made a lasting impact in nuclear medicine by providing low-dose and hybrid solutions that enhance lesion detectability and allow the user to share diagnostic information, as well as introducing innovations to the field of nuclear medicine that enhance quantitative accuracy, enable new clinical applications for monitoring cancer therapy response, and study diseases.

24×7: How does your company hope to differentiate its nuclear medicine offerings from those of competitors in the marketplace?

Barber: We believe the future of nuclear medicine resides with cadmium zinc telluride (CZT). This technology, first introduced in our dedicated cardiac cameras in 2009, has since transcended to breast imaging and general-purpose systems.

It is also a combination of software advancements and tracers being explored for faster and earlier diagnosis of patient conditions. In 2016, we introduced a general-purpose CZT system, which provides ultra-high resolution for improved lesion detectability and more accurate quantitation through improved spatial resolution of 2.8 mm versus 4.3 mm at the detector surface.

The system enables simultaneous dual-isotope imaging capabilities through improved system energy resolution (6.3% vs 9.5%), which enables the completion of multi-exams in a single visit. We understand that every investment made needs to be protected.

It’s one reason why we developed our systems in a modular design that enable in-field upgrades to either the latest CT subsystem or nuclear medicine detectors without a need to replace the entire system. After all, replacing an entire system not only drives up cost, but also increases the downtime of the nuclear medicine department’s operation.

Shalyaev: Philips’ focus and commitment to continuous health can be seen across our HealthTech organization. In molecular imaging, for example, we’ve continued down a path of innovation, developing high-quality imaging solutions that aim to increase diagnostic confidence, enhance the patient experience and care, and lower costs.

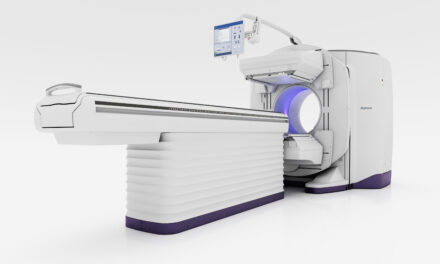

With healthcare facilities seeking new, better ways to enhance diagnostic confidence, we’re seeing a growing demand for technologies that enhance image quantification. A good example of our latest technology is Vereos digital PET/CT, which offers advances in PET performance through proprietary Digital Photon Counting technology and gives physicians the opportunity to manage dose, reduce scan times, and enhance lesion detectability.

Alvarez: We hope to differentiate our offerings in three areas: First, the current healthcare market is quite volatile until things settle down. Customers are looking for scanners that are flexible. The idea of dedicated scanners for cardiac imaging, or dedicated technology just for a subset area, isn’t enough for our customers. They [want] flexibility. When a customer purchases equipment from our portfolio of SPECT and SPECT-CT scanners, they can do multiple procedures. We don’t confine the clinician to procedures that can be done on our scanner.

The second point is hybrid use. Customers want to go beyond typical attenuation correction to make the SPECT image look nicer. Here, there will be more advanced CT technology to really combine the power of the CT with molecular imaging information.

We don’t compromise on our CT technology, so the same technology installed in a radiology facility to perform typical head, neck, chest, pelvic, and abdominal scans is the technology found on our SPECT-CTs. That’s what we create: the hybrid unit. The refusal to compromise on the CT component of the hybrid unit enables customer flexibility.

The final point is one I’m proud of and an area where Siemens Healthineers takes the lead: the area of enabling nuclear systems to be ready for theranostics in the United States. Our current portfolio now enables highly refined quantification.

That’s basically where you can monitor disease progression over time and see if your therapy is working, (similar to what is done today with a PET/CT). I think that’s really where, if a customer buys one of our systems today, it’s a 10-, 12-year investment. We will be ready when theranostics becomes as big in the United States as it is in Europe.

24×7: What are the the biggest challenges that biomeds and service professionals encounter in the servicing and maintenance of nuclear medicine equipment?

Alvarez: The first challenge is when you integrate a CT into that system. An in-house biomed may be very proficient with a gamma camera or SPECT system alone, but when you add a CT component, the level of integration can be a challenge for biomeds if they aren’t properly trained [on it].

The second challenge that I see harkens back to quality control (QC). With the market moving toward theranostics, we assume that what’s happening in Europe will come to the United States. The requirements for doing accurate, reproducible QC are becoming so important. So having the biomed trained to do the proper QC that will be driven by which collimator and SPECT isotopes are being used—QC will become more complicated.

The third challenge involves IT. As treatments on the SPECT/CT system become more advanced, the system’s software also becomes a bit more complicated as it is being integrated into the PACS or into a thin-client network. So that biomed now has to be well-versed on the IT infrastructure as well.

Barber: The rapid growth of customer in-house service groups over the past few years presents several challenges. GE Healthcare, for instance, has a wide range of nuclear medicine camera model types. That, coupled with the complexity of the technology, raises the importance of having a training solution. GE Healthcare offers a training solution to in-house service.

In-house biomeds are trained at the GE Healthcare Institute on our wide range of nuclear medicine equipment. Another challenge is when in-house teams want access to GE technology, processes, and experience—a need we meet via our AssurePoint In-House Access offering.

24×7: In what ways does your technology and/or company respond to these issues?

Barber: There are several offerings available under AssurePoint:

- Choose fixed or variable-cost service models with comprehensive parts and specialty component options

- Get access to the full range of GE service expertise and support technologies, including remote monitoring and diagnostics

- Access equipment and expertise to support biomedical and clinical engineers and technicians

- Access opportunities for system upgrades that can extend equipment life and increase performance

- Combine asset management and imaging device coverage for GE and multivendor equipment

Alvarez: Our philosophy at Siemens Healthineers is to empower our customers, our in-house biomeds, to succeed. That philosophy is ingrained into everything we do. We offer training courses for the CT component: how you align and how you deal with that integration of data in SPECT and CT. We offer courses on quality assurance and how to handle the IT infrastructure.

From a product development standpoint, we expect to come to market in a year’s time with really smart tools to take the guesswork out of what’s wrong with the system.

If an error should occur, our tools should be available on the equipment side to identify the problem, which helps biomeds lower maintenance costs and increase their response time. They will be able to fix the system faster, but also keep the uptime high. That’s where we will really empower our in-house biomeds in the future. As we progress, I think our in-house biomed customers will have more flexible options, so that we can better tailor solutions to empower them to do their jobs.

24×7: Looking ahead, what innovations can we expect to see in the next-generation of nuclear medicine technologies?

Shalyaev: As our population continues to age and we see a rise in multiple complex, chronic diseases, such as cancer, dementia, and cardiac diseases, physicians will find that they need more than just scanners to help provide accurate diagnoses and treatment. Features and capabilities in nuclear imaging solutions will continue to evolve to fit the needs of the physicians looking for better-quality imaging solutions, which will be critical to improving patient care.

In addition to market-shaping factors noted earlier, there are three key trends that have emerged and are informing the next generation of solutions, innovations, and breakthroughs:

- Increased patient engagement is driving demand for data. As the industry continues to move toward more patient-centric care and patients become increasingly more aware and involved in their health, there is a growing focus on early diagnosis and prevention.

- Making personalized medicine a reality. As personalized medicine continues to influence how we deliver care, advances in nuclear medicine and molecular imaging technologies are making it more and more critical in the care continuum.

- Integrated solutions for a 360° view of the patient. Clinicians are seeking more preemptive and definitive treatment programs, and are demanding access to integrated, comprehensive data on the patient’s diagnostic history.

Alvarez: I would say smarter tools in general. It’s integrating the equipment and the service delivery. That’s where Siemens Healthineers Molecular Imaging really differentiates itself. When we develop a product, we look at the end-to-end solution. We design the product to help on the surface end. We’ll have smart tools available to customers.

Once they become a Siemens Healthineers customer on the contract side, we identify the root cause of the problem much faster and support them to keep that system running, especially when volumes pick up and the advanced technology takes a really high peak.

Barber: We believe CZT is the future of nuclear medicine. Our latest general-purpose CZT system is just the beginning. We are exploring ways to optimize the technology to deliver better image quality, improved quantitative accuracy, easier access, and communication with referring physicians—[which is] driving both acquisition time and dose reduction.

Elaine Sanchez Wilson is associate editor of 24×7. For more information, contact Elaine Sanchez Wilson at [email protected].